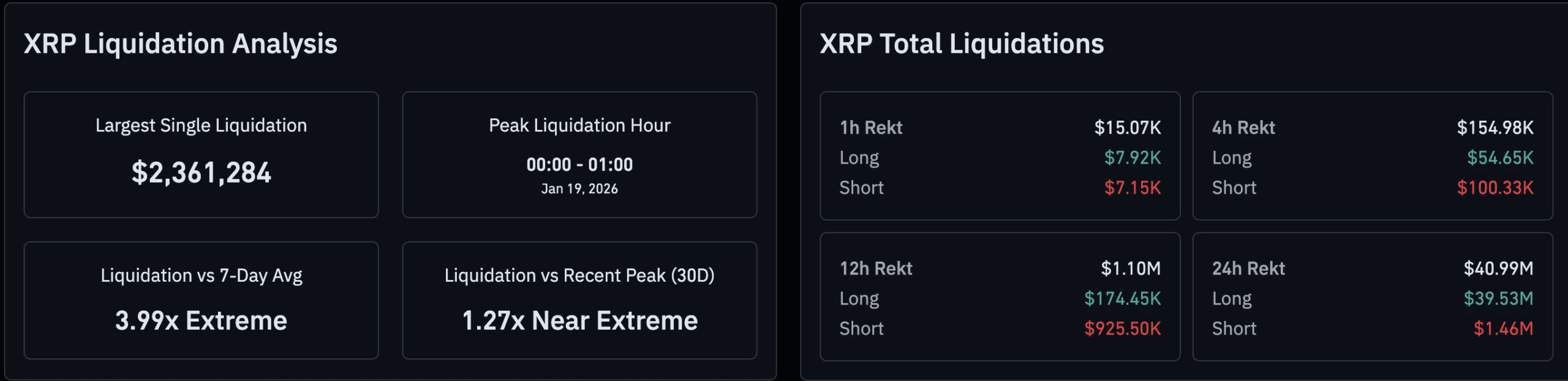

XRP dropped below $2 during the Monday morning trading session across Europe after a wave of forced liquidations hit leveraged traders, wiping out over $40M in the past 24 hours. The XRP price is now sitting at $1.97, but has a fight on its hands to reclaim the crucial $2 level.

The token slid to around $1.95 before finding a shaky bounce, leaving many traders underwater. This move fits a familiar 2025 pattern where leverage, not bad news, drives sharp XRP swings.

The break below $2 matters because it triggered automatic sell-offs on derivatives exchanges. When those kick in, prices fall fast. For everyday holders, this explains why charts sometimes look violent even when nothing “fundamental” changes.

Zooming out, XRP

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

has spent the past year stuck in leverage-driven whipsaws as futures trading continues to grow. Institutional access through products like CME futures further fueled these moves.

(SOURCE: CoinGlass)

What Caused XRP’s Sudden Drop Below $2?

This wasn’t panic selling by long-term holders. It was a liquidation cascade. That’s when traders borrow money to bet on higher prices, then get forced to sell when prices dip too far.

Think of leverage like buying a house with a tiny down payment. A small price move wipes out your equity. When XRP broke the $2.05 support, exchanges automatically liquidated positions to cover loans, pushing the price even lower.

XRP Open Interest (OI) collapsed by -63% during the historic flush in October 2025, which I covered at the time. Monday’s move followed the same script. Too many traders were long, triggering a cascading liquidation as positions were liquidated one after the other until the price bottomed, resetting the OI.

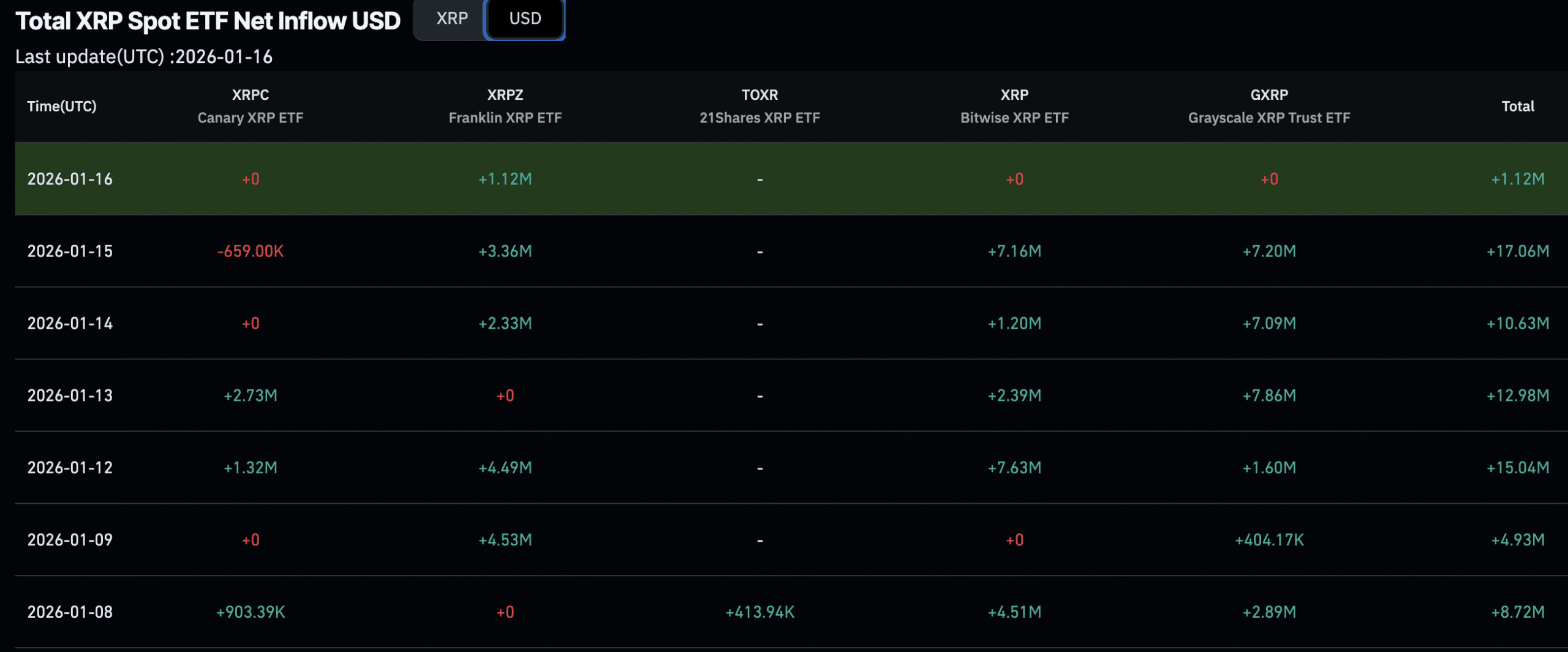

The ongoing XRP price action hasn’t been affected by spot ETFs as Ripple closed Friday in the green, marking its seventh consecutive day of positive inflows.

Per CoinGlass, over $1.18Bn has flowed into spot XRP ETFs since they launched back in November 2025, and this level of institutional demand could help stem the bleeding on the chart.

(SOURCE: CoinGlass)

EXPLORE: Top 20 Crypto to Buy in January 2026

Why Leverage Makes XRP Price Extra Volatile

XRP attracts heavy derivatives trading. Futures let traders bet with borrowed funds, magnifying gains and losses. That’s exciting. It’s also dangerous.

Per TradingView, late last year, CME-listed XRP futures hit nearly $3Bn in open positions. More leverage means more forced selling when levels break.

That’s why the XRP price can drop 5–7% in minutes while headlines stay quiet. Overleveraged positions and market structure do the damage, not bad Ripple news.

If this feels familiar, it is. We saw a similar reset during the XRP liquidations earlier this cycle and, even worse, in October 2025, when over $19Bn was wiped from the market in less than 24 hours.

What Support and Resistance Levels Matter Now for XRP USD

Higher timeframe tells the truth $XRP is super bullish.

pic.twitter.com/9Wukl25OI8

— QuantumFox (@QantaFox) January 18, 2026

Traders should now keep an eye on $1.92 as near-term support. That’s where buyers stepped in after the flush. Lose it, and another wave of stops can trigger, all the way down to around $1.80.

On the upside, if $2 resistance is reclaimed and $2.05 can be flipped, this would create a new support level. Price must close the day above $2.05 for it to signal real strength. Until then, bounces look temporary and not sustainable.

Volume tells the story. Trading spiked during the drop, then dried up. That signals forced activity, followed by traders waiting for direction. This drop does not mean XRP is broken. It does mean leverage remains a threat. If you hold spot XRP, you avoided the worst of the damage.

If you trade futures, this is your warning. High leverage turns small moves into account-ending events. Liquidation cascades feed on themselves once they start.

Simple rule. If you feel stress watching the chart, your position is too big. For now, XRP sits in reset mode. Stability must come before upside, and patience beats prediction while leverage clears out.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post XRP Price Slips Below $2 as Liquidations Hit Overexposed Traders appeared first on 99Bitcoins.