Bitcoin ETF outflows, bank contagion, and more! Here’s your weekly roundup. It took America 9 months to become a third-world country … or maybe America has been a third world country since 2008?

Seems like the US is steamrolling its way into doing all the actual bad things that the communist era Russia and China did.

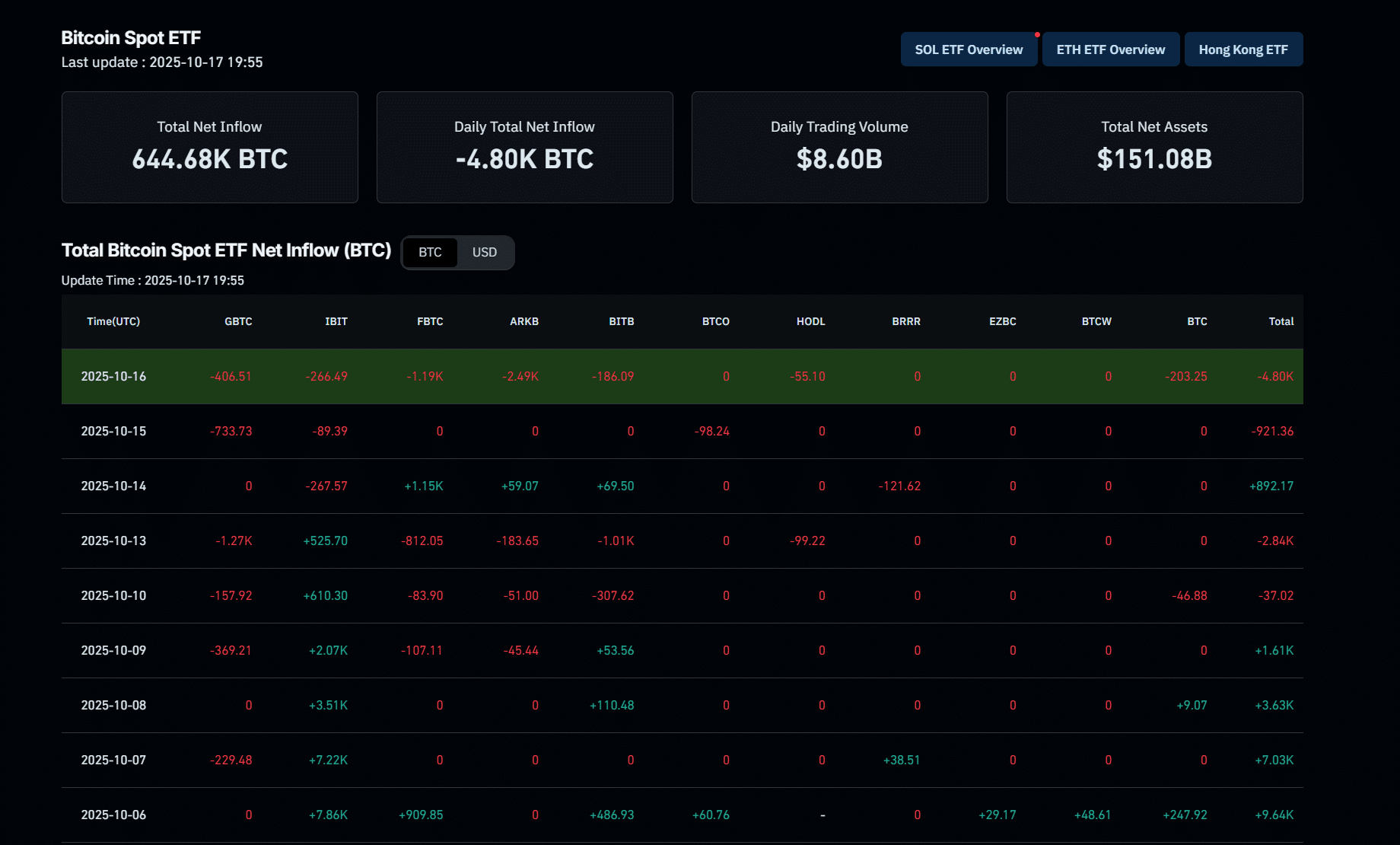

Meanwhile, spot Bitcoin ETFs recorded $536M in daily net outflows on Thursday, their largest since August 1, according to SoSoValue. Outflows hit eight of the twelve funds, led by ARKB with $275M and Fidelity’s FBTC with $132M, as investors moved to the sidelines amid macroeconomic and geopolitical uncertainty.

Here are three news stories from the week you need to know:

1. Institutional Flows Flash Red as Traders Deleverage From Bitcoin ETF

The outflows in

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

1.67%

Bitcoin

BTC

Price

$107,018.36

1.67% /24h

Volume in 24h

$44.86B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

mirror rising investor caution following one of crypto’s biggest liquidation events this year: more than $20Bn in leveraged positions erased after Trump’s announcement of 100% tariffs on Chinese imports.

Moreover, bank contagion risks have flared up, adding further pressure:

Turns out we were all right and banks have been lending against dog shit private credit for the last 5 years

H/t @SEC_digger for the chart pic.twitter.com/Wy4Iqop9rB

— Daniel A. Saedi (DataManDan) (@TheRealDanSaedi) October 16, 2025

Ethereum ETFs saw $56.9 Mn in withdrawals the same day, reversing a brief two-day inflow streak.

“The $536 million in net outflows primarily reflects a sharp surge in investor risk aversion,” said Nick Ruck, Director at LVRG Research.

EXPLORE: 20+ Next Crypto to Explode in 2025

2. Market Data Points to Caution, Not Collapse

Crypto Fear and Greed Chart

1y

1m

1w

24h

CoinGecko data shows Bitcoin trading near $$104,747, down -6.1% over the week, while total crypto market capitalization has fallen to $4.1Tn.

Trading volume remains muted as investors wait for next week’s Core CPI, Core PPI, and jobs data trifecta, all of which could steer risk appetite heading into November.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

3. SEC Chair Pushes for a US Crypto Revival

And let’s end things with one spark og good news! With capital fleeing overseas and crypto innovation shifting to Asia, SEC Chair Paul Atkins admitted the US is “a decade behind.” Speaking on October 16, he outlined plans to transform the SEC into an innovation hub and offer startups limited exemptions to test blockchain products without facing immediate enforcement.

Moments ago: Paul Atkins (Chair of SEC) says crypto's time has come. pic.twitter.com/UaPWjUx6vj

— MartyParty (@martypartymusic) October 15, 2025

Atkins also praised Asia’s superapps that blend payments, trading, and banking, arguing the US needs similar integration and coordination between the SEC and CFTC. The message was clear: bring capital home.

EXPLORE: Now That the Bull Run is Dead, Will Powell Do Further Rate Cuts?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Bitcoin ETF outflows, bank contagion, and more! Here’s your weekly roundup. It took America 9 months to become a third-world country …

- Ethereum ETFs saw $56.9 Mn in withdrawals the same day, reversing a brief two-day inflow streak.

The post Weekly Roundup: Bitcoin ETF Outflows Signal Risk Reset as SEC Chair Pledges to Revive U.S. Crypto Innovation appeared first on 99Bitcoins.