The latest FOMC news signals a clear dovish tilt among U.S. Federal Reserve officials, with the newly released minutes showing that additional rate cuts are likely before the end of the year. Most participants judged that it would be “appropriate to ease policy further over the remainder of 2025,” marking a notable shift from the cautious tone that dominated much of the year.

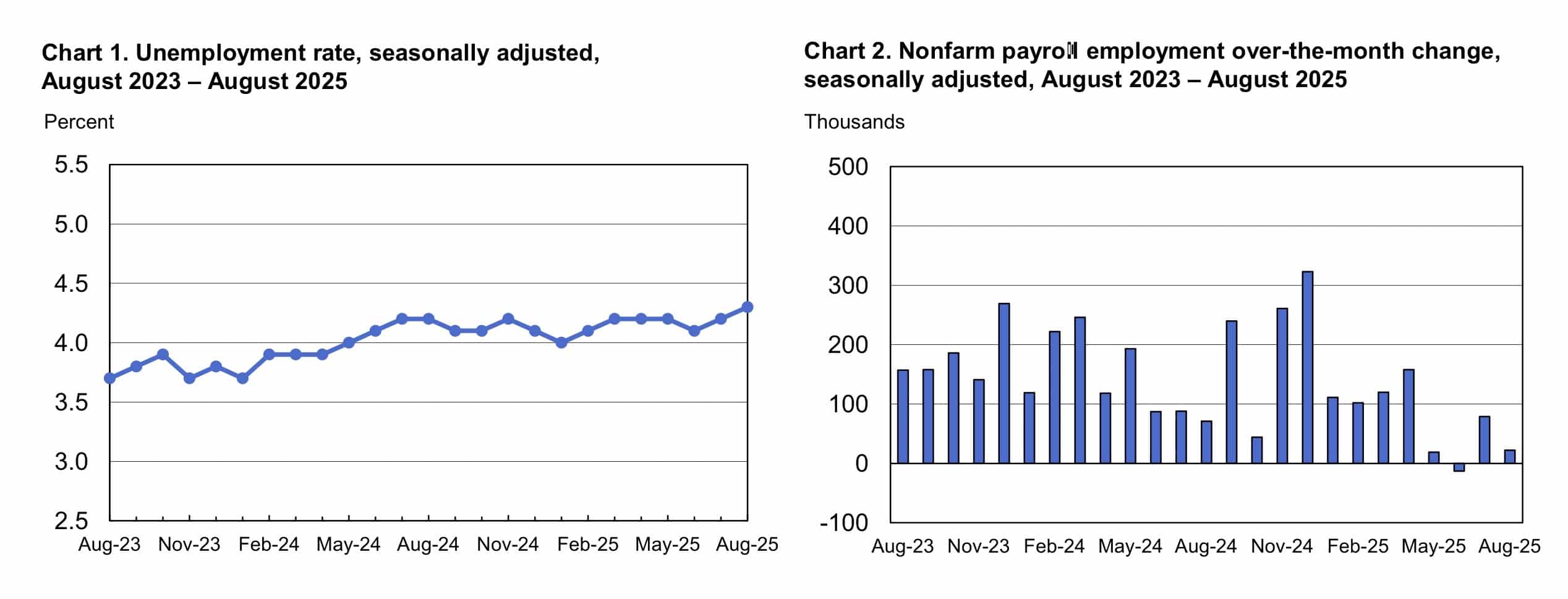

While the central bank remains officially committed to its 2% inflation target, the tone of the September meeting minutes suggests the Fed is becoming more concerned about slowing employment than lingering inflation. The first rate cut in September—by 25 basis points—was driven by signs of a softening labor market, with job gains slowing and the unemployment rate ticking higher.

EXPLORE: 15+ Upcoming Coinbase Listings to Watch in 2025

FOMC News: Two More Rate Cuts Expected in 2025

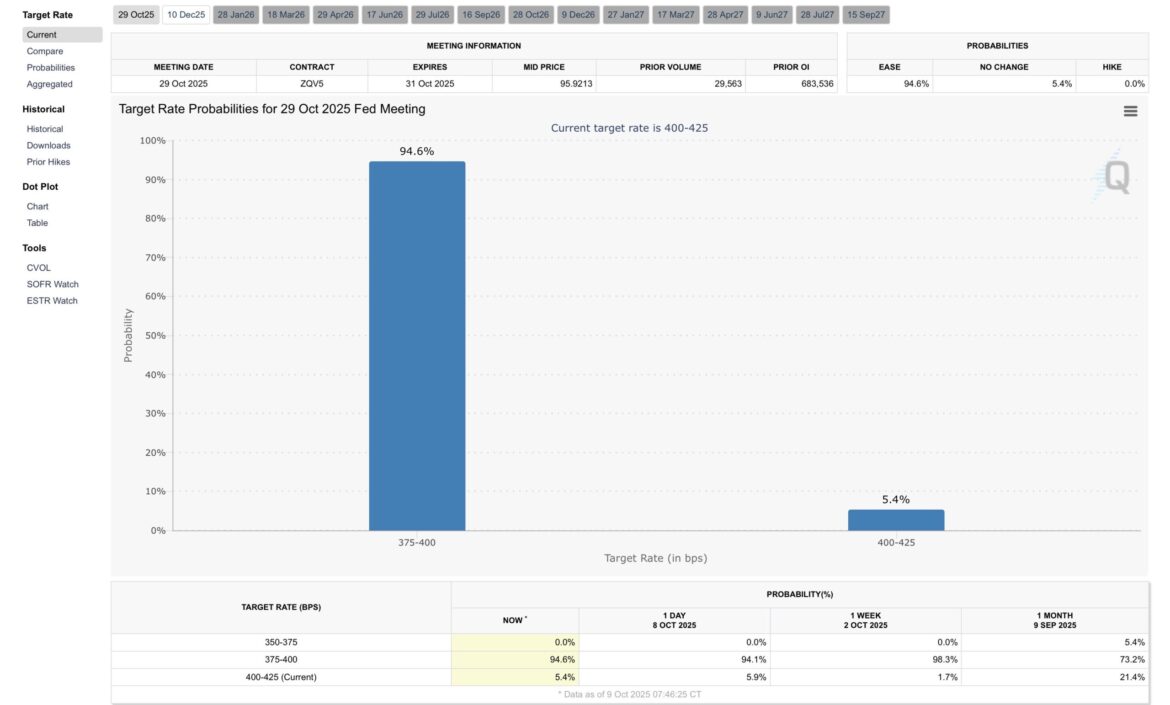

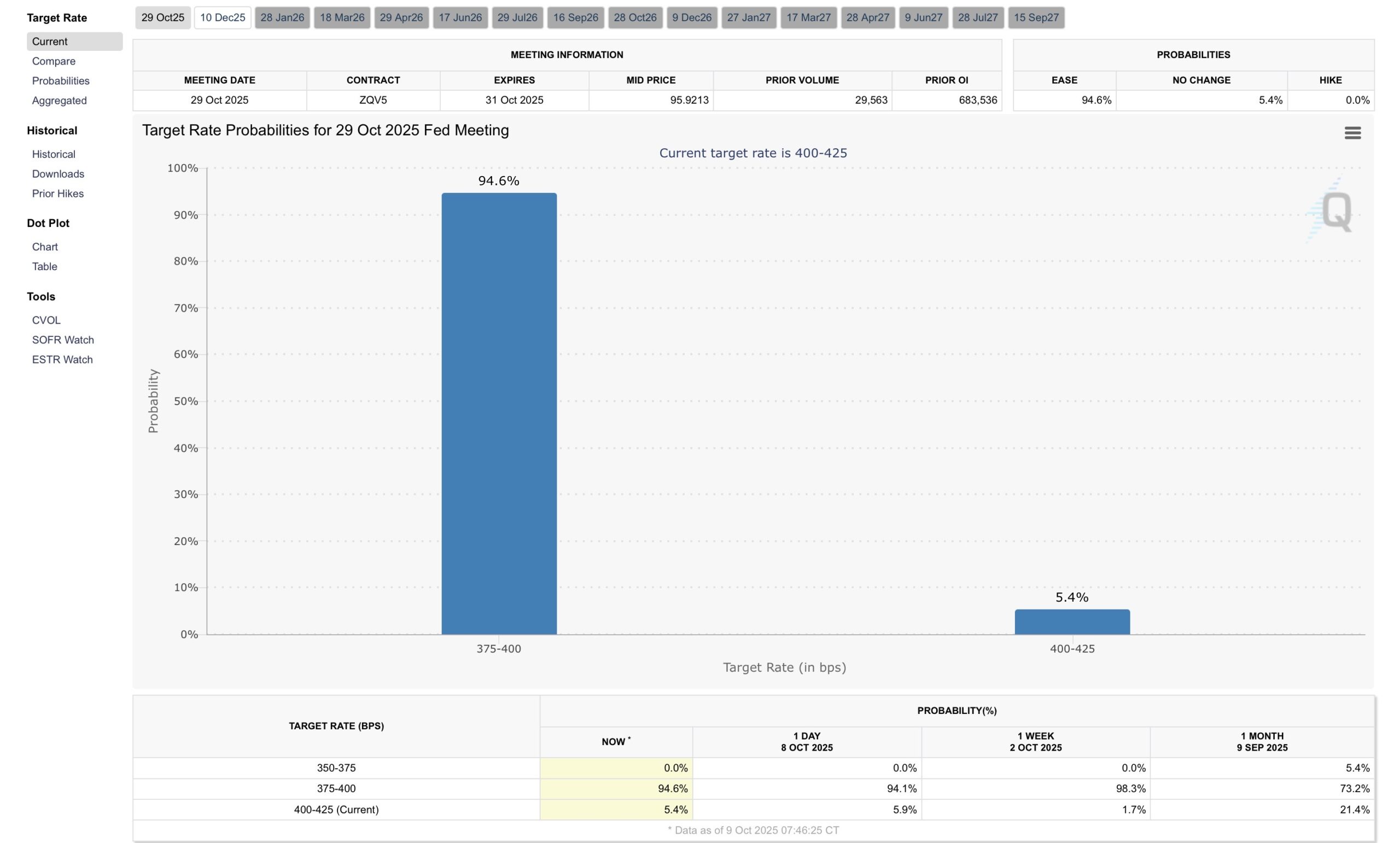

According to the Fed’s median estimate, two additional 25-basis-point (bps) cuts are expected before year-end, likely at the October and December FOMC meetings. Market expectations largely align with that view. CME FedWatch data currently shows a 92.5% probability of a 25-bps cut at the October 29 meeting.

The softer tone had an immediate impact on risk assets. Bitcoin rose following the release of the minutes, briefly pushing above $124,000 before settling around $123,500. The broader crypto market capitalization remains above $4.19 trillion.

Crypto traders often view lower interest rates as bullish, as easier monetary policy tends to increase liquidity and risk appetite across both traditional and digital asset markets. The expectation of further easing has therefore strengthened sentiment in crypto, especially after months of mixed signals from the Fed.

DISCOVER: Gold Price Hits $4K ATH, Leaves Nasdaq In The Dust — Is the Bull Cycle Toast?

The Employment vs. Inflation Debate

The FOMC’s dual mandate, maximizing employment and maintaining stable prices, has again become a balancing act. The minutes showed members were divided over whether to prioritize addressing downside risks to employment or continue pressing on inflation.

Most participants agreed that the policy stance should move toward a more neutral level given the recent labor data. They noted that inflation risks had “either diminished or not increased,” although several members remained cautious, arguing that loosening too quickly could reignite price pressures.

Kansas City Fed President Jeffrey Schmid reiterated that inflation remains “too high” and said he would prefer a more measured pace of easing. In contrast, newly appointed Governor Stephen Miran, the only official who dissented in favor of a larger 50-bps cut in September, said he is “sanguine about the inflation outlook” and supports a more aggressive approach to easing.

This split underscores a key uncertainty: whether the current rate level is still restrictive. Some members argued that the real policy stance may no longer be significantly tight, while others believe the economy could still benefit from further easing to offset labor market weakness.

EXPLORE: 16+ New and Upcoming Binance Listings in 2025

Implications for Bitcoin and Crypto

For crypto markets, the Fed’s turn toward easier policy reinforces a familiar narrative: that Bitcoin and other decentralized assets thrive when real yields fall and liquidity expands. Former hedge fund manager James Lavish noted that while the Fed is “still concerned about rising inflation,” its willingness to cut rates anyway highlights why “sound money like BTC matters more than ever.”

Traders reacted quickly to the FOMC news, with Bitcoin jumping above $124,000 before stabilizing near $123,500. In previous cycles, easing phases have often coincided with renewed upside in risk-on assets, including crypto. However, traders remain cautious after September’s post-FOMC volatility, when Powell’s comments briefly triggered a sell-off despite the rate cut.

With the next Fed meeting approaching and economic data releases delayed by the ongoing government shutdown, Powell’s upcoming speech will serve as the only major policy signal this week. Both Wall Street and crypto markets are bracing for potential volatility.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- FOMC news confirms the Fed’s softer stance, with two more rate cuts expected in 2025.

- Easier policy from the Fed lifted Bitcoin above $124,000, reinforcing optimism across the broader crypto market.

The post FOMC News: Members to Ease Policy More This Year – What it Means For Crypto? appeared first on 99Bitcoins.