In this week’s Africa crypto news, Ghana sets crypto regulations for 2025 as Binance tightens South Africa rules. Nigeria is also cracking down on unregulated firms.

The African regulatory landscape continues to adapt to the reality of a permanent crypto sector. Ghana has plans to regulate crypto. Binance also plans to update its compliance requirements to align with new rules in South Africa from late April 2025. Meanwhile, Nigeria is cracking down on unregistered crypto firms, leveling charges against Afriq Arbitrage System (AAS) and its CEO.

These stories represent the key developments from the African continent this week:

Ghana Crypto News: Central Bank Moves to Regulate Crypto

The Central Bank of Ghana has set September 2025 as the deadline to regulate cryptos, including some of the best Solana meme coins. Governor Johnson Asiama made the announcement at a summit in Washington, DC, signaling the country’s intent to oversee this industry.

The move is part of a continental shift toward standardized rules for crypto entities. Nigeria recently enacted crypto legislation to align with international crypto and securities regulation frameworks.

This shift reflects a continent increasingly accepting of crypto’s permanence. The industry has existed for over a decade, and governments are coming to terms with its presence.

Explore: 9+ Best High-Risk, High–Reward Crypto to Buy in April 2025

South Africa Crypto News: Binance Adopts New Guidelines for Users to Comply with Regulations

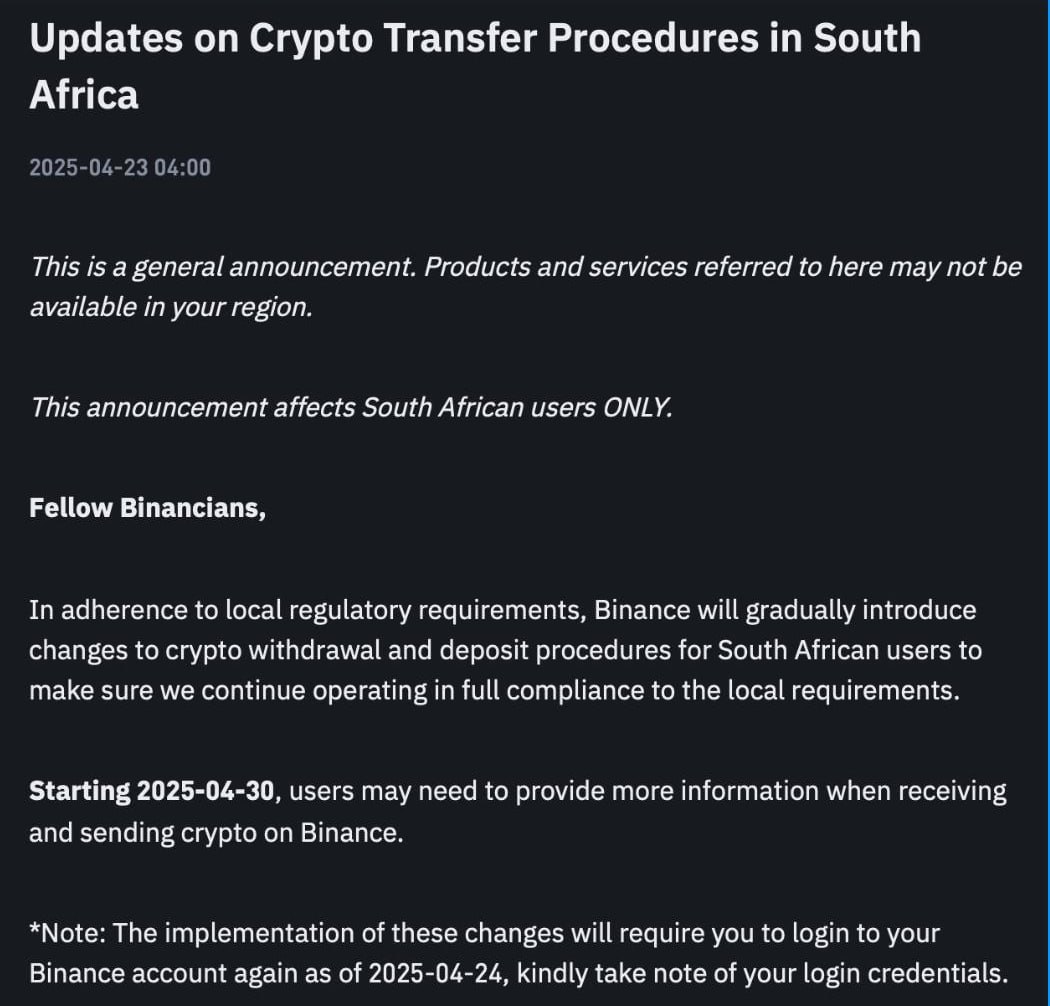

Major exchange Binance has announced stricter requirements for its users in South Africa starting April 30.

This decision follows the country’s implementation of the Travel Rule, now enforced by South Africa’s Financial Intelligence Centre.

(Source)

The Travel Rule mandates that crypto service providers collect and share information about senders and recipients of crypto transactions. Binance will now require users to provide names, recipient addresses, and exchange details for transactions.

These rules are part of a broader regulatory framework enacted by South Africa in recent months. Binance aims to comply and maintain its presence in this vibrant market. Users who fail to provide the required information risk transaction disruptions.

These changes may frustrate some crypto users who prefer anonymous or pseudonymous transactions. However, Binance has prioritized protecting its market position, cementing its place as a platform for buying some of the best cryptos in 2025.

Nigeria Crypto News: Crackdown Against Unregistered Crypto Exchanges Intensify

The Nigeria Economic and Financial Crimes Commission (EFCC) is intensifying its crackdown against crypto firms.

It recently brought charges against Afriq Arbitrage System (AAS) and Jesam Michael, its CEO. The agency claims that the crypto ramp engaged in investment fraud, which saw users lose nearly $850,000.

AAS’ engagement violated Section 44(1) of the Banks and Other Financial Institutions Act, 2020, and the agency is looking to penalize the firm as per the law.

Last year, Binance became a focal point in crypto enforcement in Africa after Nigeria charged two of its executives for, among other charges, money laundering and tax evasion.

DISCOVER: 17 Next Crypto to Explode in 2025: Expert Cryptocurrency Predictions & Analysis

Africa Crypto News: Ghana Regulations, Binance South Africa Rules, Nigeria Crypto Crack Down

- The Ghana Central Bank targets September 2025 for crypto laws, aligning with Nigeria as they regulate crypto assets

- Binance enforces stricter user data rules in South Africa to comply with the Travel Rule, ensuring market presence amid new regulations

- Nigeria is pressing charges against Afriq Arbitrage System (AAS), accusing them of committing investment fraud

The post Africa Crypto Week In Review: Ghana to Regulate Crypto, Binance To Adopt Stricter Measures in South Africa, Nigeria Intensify Crackdowns appeared first on 99Bitcoins.