The Bitcoin bull run is about to be supercharged, and this time, it’s not Michael Saylor. Bitcoin Friday is coming as CME launches Bitcoin BFF in a major Bitcoin bull run catalyst event.

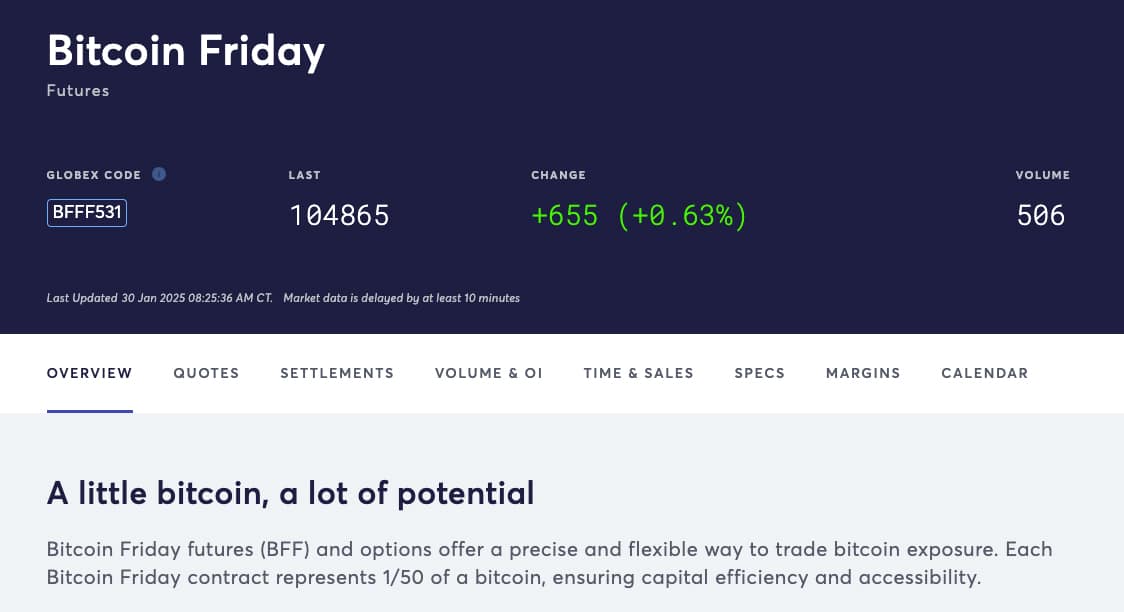

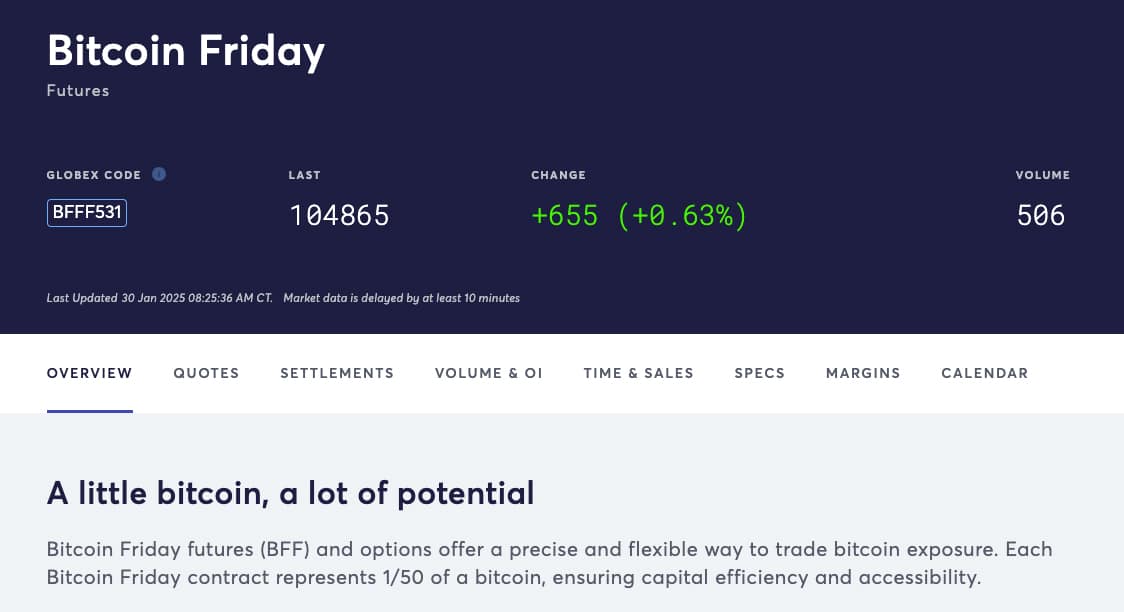

As reported recently, the Chicago Mercantile Exchange (CME) Group will introduce options on Bitcoin Friday Futures (BFF) starting February 24, 2025, subject to approval.

This will offer traders increased precision in managing short-term Bitcoin price

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

Price

Volume in 24h

<!–

?

–>

Price 7d

risks. The new BFF options will be extensions of CME’s successful BFF launch, which is bullish news for Bitcoin and crypto in general.

Bitcoin Price is Insanely Bullish: How CME’s BFF Will Compound Bullrun Potential

CME’s BFF contracts, which debuted in September of last year, quickly became one of CME Group’s most successful crypto product introductions.

Over 775,000 contracts have been traded since then, which has huge popularity among investors. These contracts are smaller in size, at one-50th of a Bitcoin, and feature daily expirations from Monday to Friday.

Giovanni Vicioso, CME Group’s Global Head of Cryptocurrency Products, highlighted the precision these new options offer traders.

Introducing these options complements CME Group’s existing offerings, which include physically settled Bitcoin and Ether options, alongside micro-sized Bitcoin and

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

Price

Volume in 24h

<!–

?

–>

Price 7d

futures.

(Source)

In addition to the developments in its markets, crypto also received a bullish boost from regulatory news. Federal Reserve Chair Jerome Powell recently indicated that banks could be allowed to offer crypto custody services.

This statement, made during a press conference, immediately pumped Bitcoin’s price.

Powell’s comments suggest a potential shift in how banks interact with crypto, offering them the chance to hold digital assets on behalf of their clients. He underlined that the Federal Reserve would continue closely monitoring the risks associated with crypto and/or Bitcoin.

Chair Jerome Powell says “banks are perfectly able to serve crypto customers.”

After mentioning bitcoin, it started rising again now at $104k pic.twitter.com/iICNx51fYg

— PEGÆ

(@ivvagiant) January 29, 2025

Before this statement, Powell had explicitly stated that Bitcoin is not a competitor to the US dollar but rather competes with gold. He describes Bitcoin as akin to digital gold. “It’s just like gold, only it’s virtual. It’s digital.”

Bitcoin has a hard cap of 21 million coins. Every 4 years, a “halving” event occurs, reducing the mining reward by half, effectively decreasing the new supply of Bitcoin entering the market. This scarcity pushes Bitcoin’s price up with increased demand. The last halving in 2024 further reduced the issuance rate, helping with Bitcoin’s deflationary nature.

While finite, new gold is mined annually, increasing the supply by about 1-2% annually. There’s no built-in mechanism like Bitcoin’s halving to reduce this supply growth. Gold comes from nature, and predicting its supply count is hard, making it more abstract as an investment.

RELATED: Bitcoin Halving Guide – How Long Will The Bull Run Be?

Bitcoin’s market cap of ~$2T represents about 11% of gold’s market cap of ~$18T.

Bitcoin is a better form of money. Bitcoin exists on computers anywhere and everywhere. In the next 5-10 years, Bitcoin’s market cap will likely surpass Gold.

6 reasons

Scarcity: Bitcoin has… pic.twitter.com/eDIgqFwVyp

— ₿rian Maass (@MaassCFO) January 25, 2025

Over the last decade, Bitcoin has proven to be an exceptionally superior investment when compared to gold. Starting from around $300 in 2014, Bitcoin’s price has blasted over $100,000 by 2024, with a staggering return of approximately 33,000%.

This means that if you had invested $1,000 in Bitcoin at the beginning of the decade, your investment would now be worth around $330,000. Gold, on the other hand, which began the decade at around $1,200 per ounce, has only seen an increase to about $2,200, offering a return of roughly 83%.

By comparison, this translates to a $1,000 investment in gold growing to approximately $1,830 over the same period.

Holding Bitcoin would have been far more lucrative over the last ten years. And no, Bitcoin is not stopping soon. It’s a million-dollar asset as institutions and smart money are joining the Bitcoin bandwagon.

MicroStrategy’s Bitcoin Bet: Michael Saylor’s Vision and Its Impact on Crypto Bull Run

In 1989, Michael Saylor co-founded MicroStrategy with Sanju Bansal. Initially focused on data mining, the company became a leader in business intelligence, mobile software, and cloud-based services.

Saylor was CEO from 1989 until August 2022, when he transitioned to Executive Chairman. This decision allows him to focus more on Bitcoin strategies.

Michael Saylor took MicroStrategy public in June 1998, with shares initially priced at $12, doubling on the first day of trading. By early 2000, his net worth had soared to $7 billion, making him one of the wealthiest in the world.

In 2020, MicroStrategy announced it would use Bitcoin as its primary treasury reserve asset, a decision that led to purchasing over 471,107 Bitcoins by early 2025, valued at approximately $30.4 billion.

Saylor is willing to stomach criticism from the maxi’s in order to make Bitcoin “less sketchy”

and provide cover for institutions to deploy capital into BTC and pump our bags

Legend

— Mitchell

(@MitchellHODL) October 21, 2024

Saylor has become a vocal advocate for Bitcoin, appearing on numerous podcasts and media to discuss its potential as a hedge against inflation. Under his guidance, MicroStrategy has made significant investments in Bitcoin.

These actions have positioned MicroStrategy at the forefront of the future of financial shift. This prompts the question: what are you waiting for if you’re not doing the same?

EXPLORE: 15 New & Upcoming Coinbase Listings to Watch in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post CME Has a Secret Plan To Supercharge The Bitcoin Bull Run: What is Bitcoin BFF? appeared first on 99Bitcoins.