Tokyo-listed Metaplanet plans to issue Class B perpetual shares worth $135 million to expand its Bitcoin reserves.

Summary

- Metaplanet announced issuing about $135 million in shares to buy Bitcoin

- Class B shares will have no voting rights, but will have redemption at listing

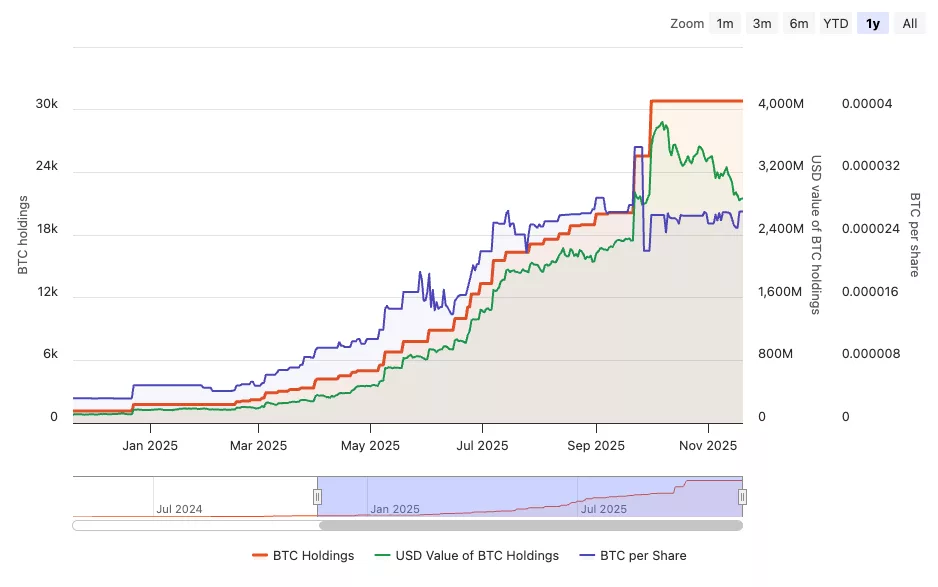

- The firm currently owns 30,823 Bitcoin, worth about $2.69 billion

As corporate Bitcoin adoption strengthens worldwide, one Metaplanet is taking an increasingly aggressive approach. On Thursday, November 20, the Tokyo-listed Bitcoin treasury firm announced the issuance of 23.61 million Class B Preferred Shares, valued at about $135 million.

The firm will use the proceeds of these sales from these sales to expand its Bitcoin holdings. The firm will issue these shares at ¥900 per share, with an annualised 4.9% dividend rate. Holders will then be able to convert these shares into common shares, which hold voting rights.

What is more, holders will be able to redeem their shares if they are not listed by 20 business days after Dec. 29, 2026.

Metaplanet mirrors Strategy in Bitcoin accumulation

The issuance of Class B Preferred Shares mirrors the model used by Michael Saylor’s Strategy. Notably, it enables the firm to raise more capital to pursue its aggressive accumulation. While the issuance initially dilutes shareholders, it does not immediately increase common stock. For that reason, its profitability hinges on Bitcoin’s near-term growth, which Metaplanet is betting on.

“The Company believes that Bitcoin will deliver long-term returns that exceed the preferred share dividend yield,” Metaplanet wrote in the filing.

Currently, Metaplanet holds 30,823 BTC, worth approximately $2.69 billion. The firm purchased its Bitcoin at an average price of $108,036, and is down 19.33% on its investment. Despite this, the firm has $3 billion in market cap, which is higher than its BTC holdings.